Evolution AI

Review ratings

Integration support

API

Ideal for

Large teams (20-150 employees)

Price

Paid

Gallery

About Evolution AI

Evolution AI is a data extraction tool that leverages generative AI to streamline the retrieval of financial information from diverse documents, such as financial statements, invoices, and bank statements. The platform aims to improve efficiency and precision in financial analysis by rapidly capturing and processing intricate data, enabling users to calculate essential financial metrics without the need for manual input. It caters to various industries, including commercial finance, private equity, and insurance, and provides an intuitive interface along with comprehensive customer support.

Evolution AI key features

Automated Data Retrieval: Leverages generative AI to retrieve information from a variety of financial documents, such as financial reports, invoices, and bank statements, eliminating the need for manual data entry.

Adaptive Accuracy Improvement: The system enhances its precision over time through adaptive learning, enabling users to rectify mistakes and improve data integrity.

Extensive Document Processing: Capable of handling large documents concurrently and categorizing them based on type (e.g., balance sheet, income statement).

Essential Financial Metrics Calculation: Automatically calculates crucial financial metrics like EBITDA, EBIT, and various financial ratios from the retrieved data.

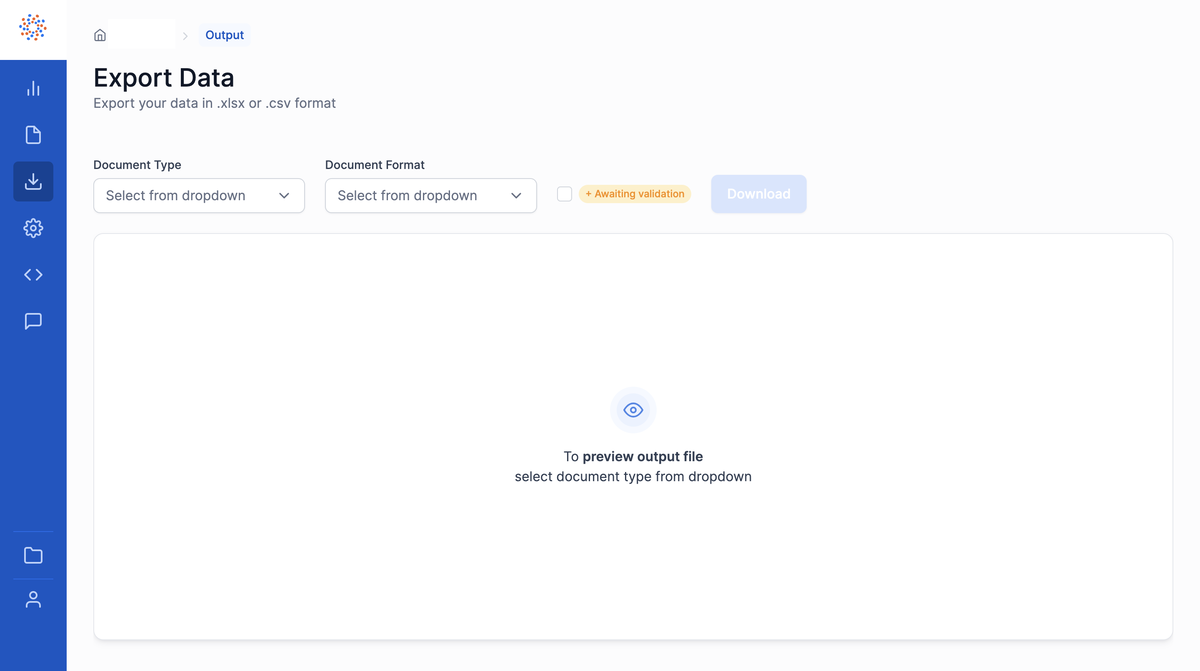

Intuitive User Interface: Includes a straightforward point-and-click interface for document setup, allowing users to effortlessly locate and extract required data points.

Evolution AI use cases

Automating the extraction of data from financial reports to minimize manual input time for asset managers, thereby enhancing both efficiency and precision.

Optimizing loan underwriting workflows by swiftly retrieving essential financial metrics from bank statements and financial documents.

Improving the speed and accuracy of underwriting processes in the insurance industry by capturing pertinent data from financial reports.

Assisting M&A professionals in assessing potential acquisition targets by providing quick access to organized financial data and critical performance indicators.

Enabling private equity firms to scrutinize financial statements for identifying discrepancies and calculating vital financial ratios to inform better investment choices.

Useful for

Streamlines data extraction from intricate financial documents, markedly decreasing the time required for manual input.

Improves the precision and integrity of extracted data using adaptive algorithms and quality control measures.

Delivers immediate access to essential financial indicators, enabling faster decision-making across various financial services.

Accommodates a variety of document types and formats, including low-quality scans, ensuring flexibility in data processing.

Facilitates smooth integration with current IT infrastructures through REST API, optimizing workflows for finance professionals.